Why we haven't seen a Stripe-sized company in analytics

and how OpenAI's $1.1B Statsig acquisition could change that

Analytics companies are kinda mid

Y Combinator has funded a total of 117 analytics startups. Four rise to their distinction of "Top Companies": Amplitude, Segment, Heap, and Mixpanel.

YC's startup directory filtered for "Analytics" and "Top Companies"

All four were backed at least 12 years ago, the earliest in summer 2009, or roughly when Facebook eclipsed MySpace.

There's no doubt these bets did very well for YC and other early investors. And yet relative to the market potential even these big dogs seem "kinda mid," as someone their age might say.

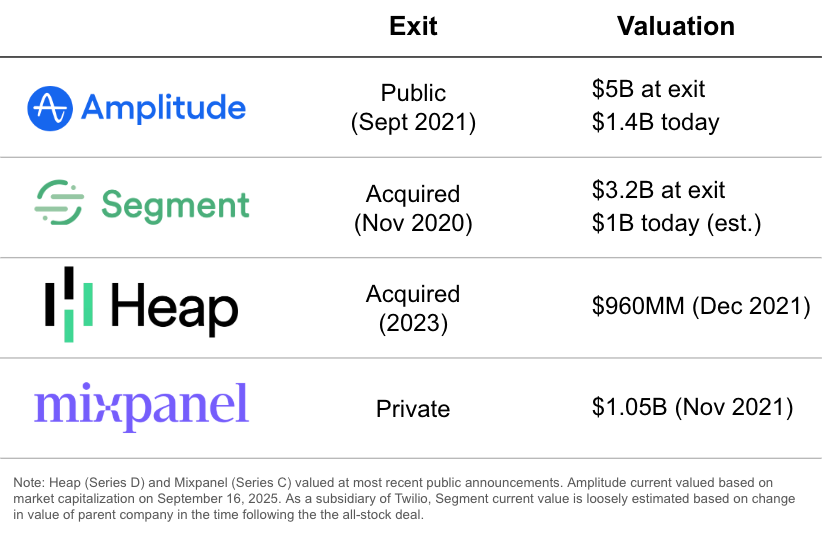

Valuation comparison for analytics leaders1

Combined enterprise value for the lot probably stands at less than $5B all-in. For comparison, that's around half the market capitalization of Gitlab, one YC-backed B2B company that isn't even the biggest in its category.

To be clear, these four were the winners. It's not like Y Combinator missed the boat on analytics. They essentially bought the index2.

These tigers can't change their stripes

I named Stripe in the title of the piece because they are an absolutely massive (roughly $100B) YC-backed company that also plays in a market that can touch virtually every business on earth. They first established themselves with a superior experience for developers; Segment had a similar selling point: turn event tracking into a single snippet of code.

The key difference is that with Stripe, making the API call is the end-to-end process of value creation. If the "job to be done" is payment, then write and test the code, and boom, job's done.

Analytics doesn't work that way. In fact, the API call is only the start of it. The full job requires a path to insight and more crucially – action – from human beings who consume the data.

Mega, decacorn level, success in analytics has been stymied by:

- Lack of compounding benefits to scale

Analytics products are the same whether they serve 100 customers or 100,000 (unlike Stripe, for example, which improves in fraud prevention). - Challenging ROI visibility

It is difficult to draw a straight line from the subscription invoice to value creation. To many CFOs these tools are a necessary evil, or worse, a nice-to-have, not critical infrastructure or no-brainer growth drivers - Misalignment among customer teams

Requires buy-in from diverse groups including engineers, marketers, product managers, and of course "data people" - who are often the owners in name only. Differing priorities and incentives make it difficult to align for highest impact.

It's worth noting that YC backed four companies that are largely competitors, however competition is not the root issue.

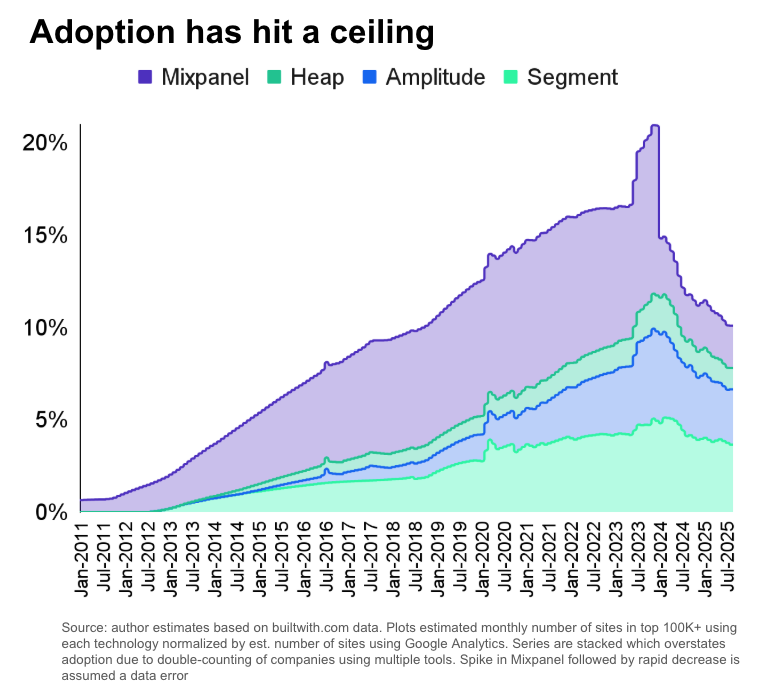

The current model is tapped out

The net result is that the category is leveling off after having penetrated one-tenth of the serviceable market. Segment, owned by Twilio, reported 0% revenue growth year-over-year in Q2 20253. Amplitude reported 13.6%, down from a peak of 70% in 20214. Both are stuck in the low hundreds of millions in ARR. Heap and Mixpanel, though without public disclosures, are likely in a similar position.

Estimated adoption trend show leveling off of analytics customer base

What comes next? Watch OpenAI

"This space has changed the way we build products."

Bold claim from a Hacker News poster, but I agree.

Are we to conclude such influence is not that valuable? Is being data driven a fad?

No and no. In fact, I think the LLM era is about to blow the roof off.

See OpenAI's acquisition of Statsig earlier this month for $1.1B. It appears to me they paid a significant premium given the size and growth rate of the business5, justified by the unique potential for a combined entity.

That potential comes into focus when you map it against the very blockers that kept past analytics companies "kinda mid." Where others stalled, OpenAI may have a path through:

- Returns to scale: OpenAI's role as both model provider and app builder – and their overall clout – gives them room to set terms on how learnings flow across customer accounts to allow for compound benefits

- ROI visibility: Automated insights and direct actions can close the loop from data to value, making the payoff more immediate and obvious.

- Team alignment: AI agents can cut across silos and take on work time-constrained people can't, reducing the coordination bottlenecks that have long limited impact.

I predict OpenAI will build a revolutionary analytics application that addresses these limitations, leaning on engineering automation. Perhaps more importantly, in a world where every foundation model provider trains on the entire public Internet, proprietary data made available by this tool will help OpenAI differentiate their model offerings.

I don't know how exactly they'll do this, but the Stripe comparison is interesting to come back to. Stripe has reported success applying transformer models to their massive payments dataset to generate results that improve upon prior ML methods. I suspect a similar approach could be used with event data, the bread and butter of analytics companies (think transactions but also page views, message sends, and every flavor of button click)6.

Conclusion

As it turns out, we may never get a Stripe-level outcome in analytics as an independent company. But with recent AI advances, OpenAI has a real shot at overcoming historical shortcomings and building an analytics business line that could be worth at least that much.

I for one will be happy to see them try.

Notes

- 1. Heap raises $110M Series D, Amplitude valued at $5B on Nasdaq debut, Twilio buys Segment for $3.2B, Mixpanel secures $200M growth investment ↩

- 2. There have been interesting and growing companies founded more recently notably Rudderstack (which dear reader, is present on this very page), Post Hog (YC Winter 2020), and Statsig (as discussed later) ↩

- 3. Twilio Q2 2025 earnings report. New customer revenue was basically neutralized by churn ↩

- 4. Amplitude earnings report ↩

- 5. Based on builtwith.com data, Statsig is perhaps around 20% of the size of Amplitude and was purchased for about 80% of Amplitude's valuation. It appears to be growing by about 30-40% year-over-year, A healthy clip for sure, but by no means stratospheric in today's market, and probably not itself enough to justify a multiple hundred percent premium to fair market value. ↩

- 6. Segment processes 400k every second ↩